In simplest terms, it means return on return. Benjamin Franklin said: ”Remember that money is of a prolific, generating nature. Money can beget money, and its offspring can beget more.”

Compounding is a simple, but a very powerful concept. Why powerful? Because compounding is similar to a multiplier effect since the return that is earned by the initial capital also earns a return, the value of the investment grows at a geometric (always increasing) rate rather than an arithmetic (straight-line) rate.

One of the biggest benefits that investors can appreciate about the power of compounding is the value of time. With time, you could gain returns, and the yields on these returns could further generate returns; thus, helping to increase your investments quickly.

Let us understand the concept of Compounding with a story.

Let’s take an example –

As can be seen from the above chart, by holding an investment of Rs. 1 Lakh for 38 years, Value becomes Rs. 74.17 Lakhs. By holding the same for 1 more year only (for 39 years), additional gain is Rs. 8.90 Lakhs (83.08-74.18). By holding for 1 more year, additional gain is Rs. 9.97 Lakhs (93.05-83.08). As can be seen, the power of compounding works wonders as the investment holding period increases.

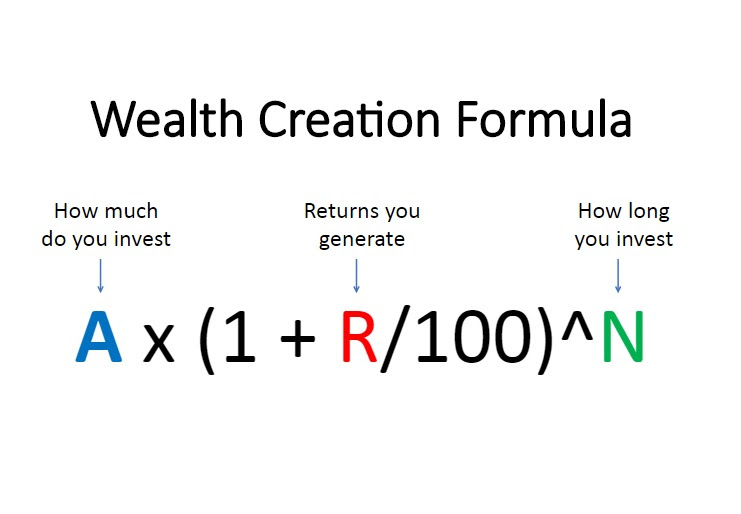

Most of the investors are focused on ‘A’ and ‘R’ whereas the main focus should be on ‘N’. Power of Compounding works wonders for those who focus on ‘N’ i.e. those who give time to their investments. Many investors tend to be overtly active and try to time the market by exiting from their investments and waiting to deploy them again when markets correct. What they tend to gain by price difference (if at all they are able to accurately execute their timing) is much lower than what they tend to lose by giving up the power of compounding.

Famous quote of legendary investor Mr. Warren Buffet – “Our favourite holding period is forever.” If one owns sound investments and do not need the funds, one must never exit, irrespective of market levels.

Imagine you invest Rs. 5,000 every month. The interest on this amount is 10% per annum. The below table reveals how your investment returns would look like over time:

The best way to take advantage of compounding is to start saving and investing wisely as early as possible. The earlier you start investing, the greater will be the power of compounding. You don’t need to be a financial expert to benefit from the power of compounding. Every investor can take advantage of this concept and put it to good use. So, start investing today to enjoy a great future.